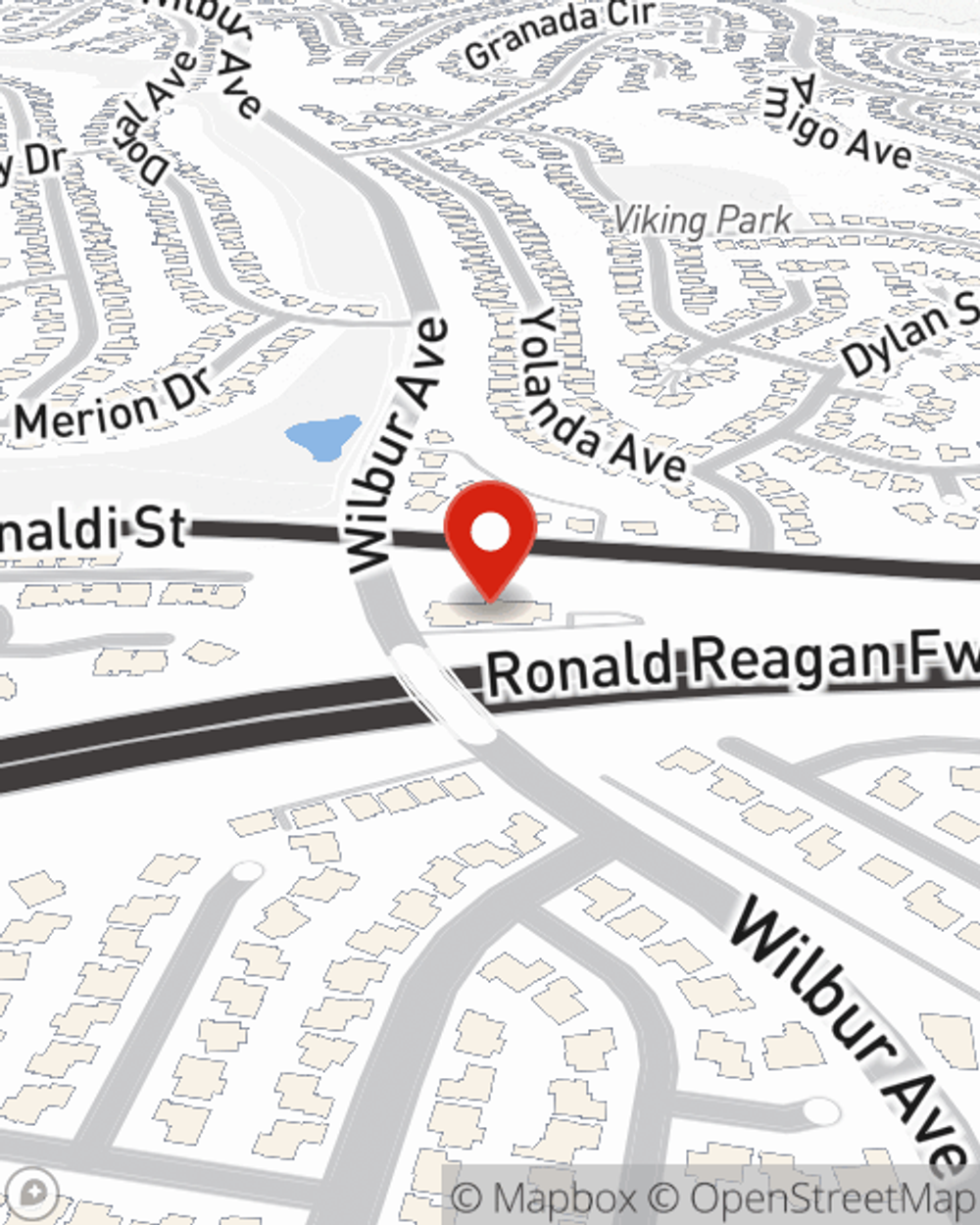

Business Insurance in and around Northridge

Calling all small business owners of Northridge!

Helping insure businesses can be the neighborly thing to do

Cost Effective Insurance For Your Business.

Do you own a photography business, a book store or a clock shop? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on making this adventure a success.

Calling all small business owners of Northridge!

Helping insure businesses can be the neighborly thing to do

Strictly Business With State Farm

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for commercial liability umbrella policies, artisan and service contractors or business owners policies.

Since 1935, State Farm has helped small businesses manage risk. Call or email agent Lacey Greenberg's team to discover the options specifically available to you!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Lacey Greenberg

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.